Comprehensive Retirement and 401(k) Plan Administration

As a business owner, you deserve a partner that will take on the ins and outs of your retirement plan administration, including compliance audits and paperwork, fielding employee questions and requests, and more—so you can focus on running your organization.

As a Third-Party Administrator or TPA, retirement is RPSI’s exclusive focus. Delivering stress-free retirement plan administration has been the measure for how we serve clients since 1992. Schedule a consultation today.

Keeping Your Plan on Track as the Business Grows

It’s important to understand that as your business grows, your retirement plan needs will change. So you need your TPA partner to proactively monitor your plan AND make proactive adjustments to keep your plan on track.

The RPSI process delivers a solution to meet your needs today and continues to monitor your plan and makes suggestions to ensure the plan remains the best fit for your business and employees. Our proprietary process:

Using our proven process, our team crafts the optimal plan design for your business. Then we track all the retirement plan compliance and legislative details for your plan so you and your employees can focus on growing the business. And you get to enjoy the peace of mind from knowing you have a team of professionals behind you.

You're covered with

The RPSI Process

Relieving the Burden of Retirement Plan Administration

The ongoing shifts and changes in compliance details and audits required for any retirement plan make staying on stable ground a challenge for today’s company plan sponsors. As a Third-Party Administrator (TPA), our comprehensive retirement plan services offer you the very real benefit of peace of mind, as well as freeing up time on your calendar.

We weigh your needs against our experience with hundreds of companies and our understanding of the regulatory environment.

We’ll help guide your choice based on your budget, goals and company mission.

Our staff and your plan guru are always available to offer guidance and make adjustments.

Our ERISA attorney keeps you compliant and apprised of all regulatory changes. Plus, you receive signature-ready filing (5500) and annual documentation.

Have your goals changed? We advise an annual meeting to make sure your plan tracks your company life cycles.

Relieving You of the Burdens of 401(k) Plan Administration

Overseeing retirement plan details or becoming the pension plan administrator adds another layer of responsibility to you or someone on your staff. It’s the day-to-day employee questions, hires/fires, paperwork and forms that can quickly drive you crazy—and drain time and energy from your primary responsibilities.

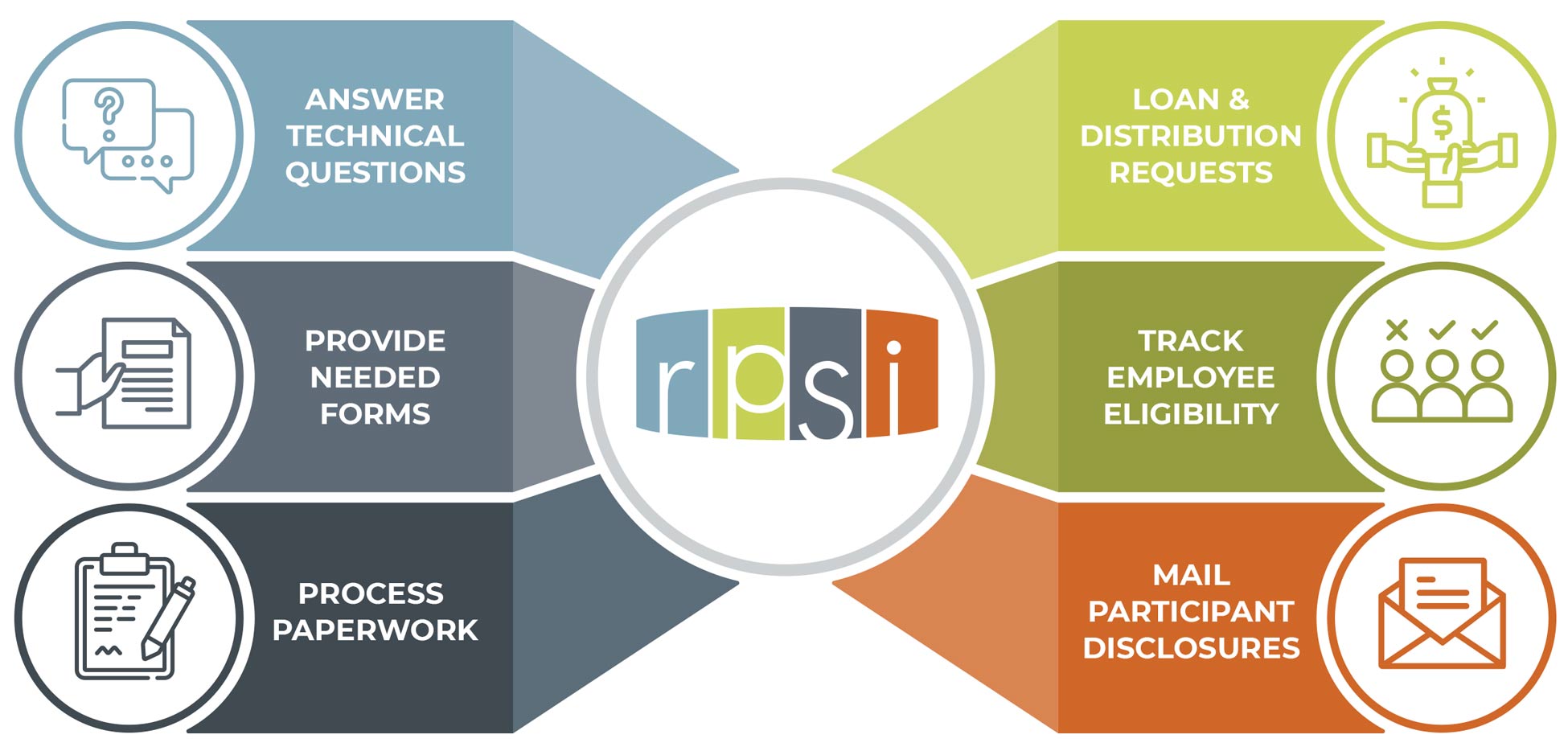

RPSI removes the frustrations and headaches associated with retirement plan administration. Our team can coordinate all these communication details:

Helping You Manage Fiduciary Responsibilities

What is a 3(16) Fiduciary?

Should you need an extra level of support, we can also serve as a Fiduciary to the plan. An ERISA 3(16) fiduciary acts as THE plan administrator. The 3(16) administrator is responsible for managing the day-to-day operation of the plan.

As a 3(16) Fiduciary, RPSI handles:

- Loan and Distribution Management

- Accept signing authority for loans and distributions

- Review and approve QDROs

- Approve hardship distributions

Participant Notices (Mailing Services)

- Review provider notices

- Mail notices to participants

Government Filing Services

- Review and sign the Form 5500

- Review the audit report